Department of Economics

We are a vibrant community combining rigorous analytical tools with social issues of equity and sustainability.

Department of Economics

We are a vibrant community combining rigorous analytical tools with social issues of equity and sustainability.

Get to Know Us

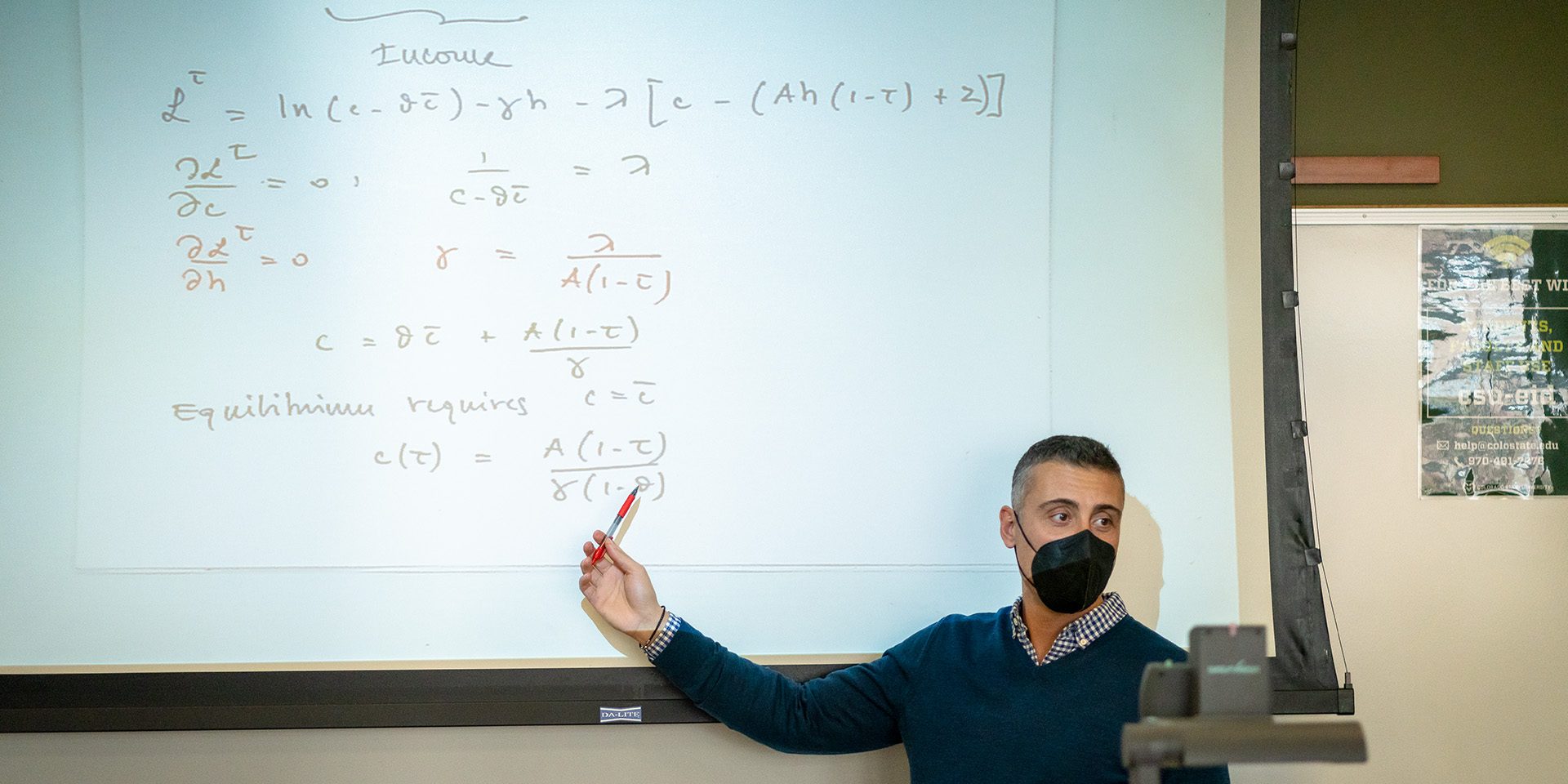

As part of CSU’s College of Liberal Arts, we go beyond supply-and-demand to address big-picture debates about economic perspectives and policies. Explore our department’s latest research and meet the people who make our work possible.

Who Are You?

Undergraduate Students

Prepare for your future in a major with flexibility, rigor, and real-world impact.

Ph.D. Students

Discover our reputation for excellence in political economy, environmental economics, regional economics, and more.

Find Your Community

In the Department of Economics at CSU, you will be immersed in a vibrant learning community that supports the intellectual development and professional aspirations of its students and faculty. Our faculty members are caring teachers and prolific scholars who have active research agendas, providing many opportunities for both undergraduate and graduate students to collaborate. Our goal is to prepare our students to be critical thinkers who understand the debates about economic methodology and policy, as well as the techniques of economic analysis.